Thank you to all those in attendance at the Arc Ventures Fall Drinks event! We hosted over 80 people on the beautiful terrace overlooking Grand Central. It was great to come together and reconnect. Looking forward to seeing you again in the near future.

Blog

Decision Making in Venture Capital: The Numbers and The Psychology

Intro At business school, an important skill we learn is how to value companies. We learn the basics of constructing DCFs, the important information we need from financial statements, and how to use past data to make sense of new ones. However, our professors rarely (Prof. Damodaran is an exception) bring up the biases that…

How Innovative FinTech Startups are Disrupting Traditional Banks – a Venture Capital Perspective

With an increasing number of neo banks emerging and getting more news coverage, I thought it would be interesting to analyze the effect of FinTech companies on traditional banks. There are broadly three types of startups currently receiving a large amount of VC funding, looking to challenge traditional banks. The first kind are building robo advisors and other complimentary financial advisory tools to replace the good old (human) financial advisor. Then there are money transfer businesses such as TransferWise (now called Wise) eating into traditional banks’ high fees for such…

A Gen-Z View on FinTech

A few takeaways from the above: Capturing the Gen-Z market heavily requires demystifying the financial processes first. Even the oldest of our generation are paying taxes for the first time, confused about building credit, and oblivious to retirement plans. This does not mean we are apathetic about financial health; it shows how nobody explained what being financially healthy was. Fintech…

When will current Series A startups raise their Series B?

When will current Series A startups raise their Series B? Someone recently asked me this question, so I built a prediction model to help generate an answer. Keep reading as I discuss my process and give actual Series B predictions. Where to begin? I began by pulling together metrics that made sense for a company trying to raise a Series B. My thinking first went to a company's finances…

30 Questions with Eric

https://www.youtube.com/watch?v=N5YlKZmyh4w We're excited to release our first episode of 30 Questions with Arc Ventures! Each month, we will invite one team member to talk about their own stories by answering 30 rapid-fire questions. This month, Eric Kohlmann talks about his work at Arc Ventures, favorite pandemic drink, and what he loves to do on weekend!

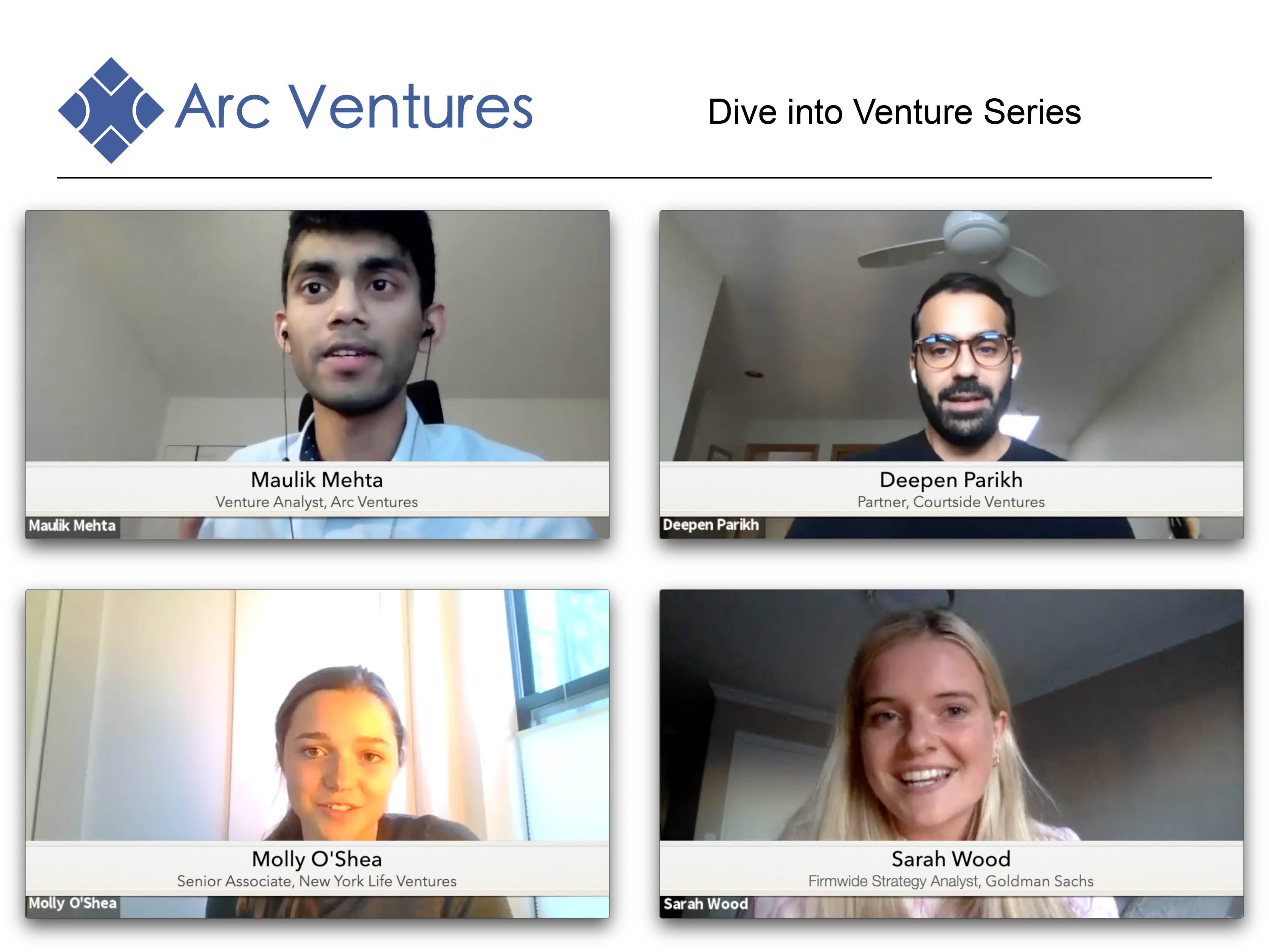

Dive into Venture Series – Part I

ChargePoint, Inc. to Become Public Company

Arc portfolio company ChargePoint announced that it will become a public company through a business combination with Switchback Energy Acquisition Corporation (NYSE:SBE), valued at $2.4 Billion. The official press release can be found here. ChargePoint, Inc. to Become Public Company, Advancing EV Charging Network’s Reach Across North America and Europe Business Combination with Switchback Energy…

My Journey Into Venture Capital – Part I

PolyPid Ltd. Announces Closing of Initial Public Offering

PolyPid successfully completed its initial public offering on the NASDAQ, June 30th 2020. Arc Ventures first invested in the company in 2016. You can find more information about the investment here. PolyPid's original press release can be found on its website. PolyPid Ltd. Announces Closing of Initial Public Offering and Full Exercise of Underwriters’ Option…