When will current Series A startups raise their Series B?

Someone recently asked me this question, so I built a prediction model to help generate an answer. Keep reading as I discuss my process and give actual Series B predictions.

Where to begin?

I began by pulling together metrics that made sense for a company trying to raise a Series B. My thinking first went to a company’s finances and whether they seem attractive to venture investors.

- – The company should achieve $10M in Annual Recurring Revenue (ARR).

- – The startup should grow 50% over the last two years with a 70% gross margin and 90% retention.

- – The company should have a diversified customer base and a strong LTV/CAC Ratio (Lifetime Value / Customer Acquisition Cost).

The issue here is that we are talking about private companies, and their financial information is not readily available. So, I started speaking about this more and more with my team and other fund managers. These discussions presented more data points that we look at:

- – The amount of cash raised in the last financing round and total?

- – What is the current burn rate?

- – How many founder shares have been diluted?

In reality, it is difficult to predict when a company would or could raise their Series B financing round, even if all of these variables are known. This problem motivated me to create a prediction model using data science and machine learning techniques.

Building the dataset

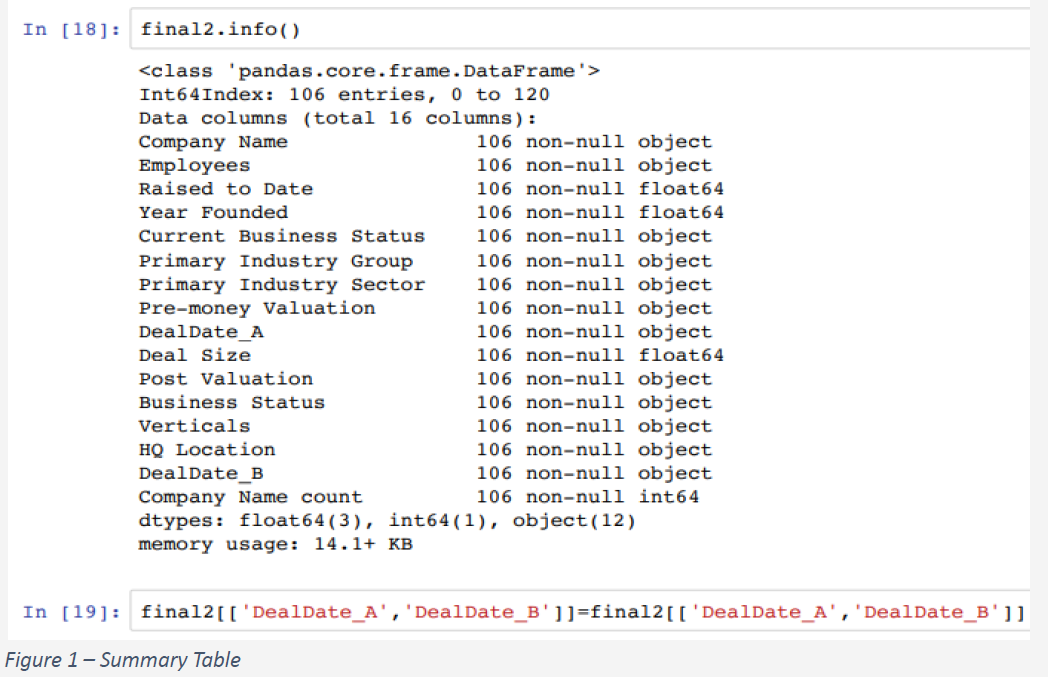

To build a predictive model using machine learning, you need to start with a dataset. I began scraping and extracting web content of over 700+ companies that raised a Series A and/or a Series B round in the last six years. Once this was generated, I cleaned the data by removing redundant variables, and also created new variables like the following:

- – Year Founded

- – Length of time between Year Founded and Series A

- – Difference between Series A and Series B pre-money valuations

- – Length of time between Series A and Series B

(Actually, there were a lot more variables 😊 – appropriately showcased in Figure 1.)

I used these inputs in a random forest regression analysis. The table below is a sample representation of how I trained the model. There are five companies below in Table 1 that have all raised a Series A and Series B rounds within the last six years. This makes it easy compare differences in employee count, pre-money valuation, and time between the Series A and Series B rounds.

| Company Name | Employees during the round | Raised to Date (USD Million) | Year Founded | Pre-money Valuation (USD Million) | Series | Deal Date | Round Size (USD Millions) | Post Valuation (USD Millions) |

| 15Five | 37 | 12 | 2011 | 43.9 | Series A | 29-Nov-18 | 8.2 | 52.1 |

| 15Five | 160 | 42.7 | 2011 | 102 | Series B | 17-Jun-19 | 30.7 | 132.7 |

| Abstract | 17 | 8.25 | 2015 | 19 | Series A | 19-Jun-17 | 6 | 25 |

| Abstract | 32 | 24.25 | 2015 | 60 | Series B | 24-May-18 | 16 | 76 |

| ActionIQ | 40 | 14.7 | 2014 | 45 | Series A | 3-Apr-17 | 13 | 58 |

| ActionIQ | 40 | 44.7 | 2014 | 104 | Series B | 23-Oct-17 | 30 | 134 |

| Algolia | 21 | 21.21 | 2012 | 50 | Series A | 6-May-15 | 18.39 | 68.39 |

| Algolia | 115 | 74.2 | 2012 | 255 | Series B | 8-Jun-17 | 53 | 308 |

| Allbirds | 15 | 9.95 | 2014 | 25 | Series A | 7-Sep-16 | 7.25 | 32.25 |

| Allbirds | 80 | 27.45 | 2014 | 350.2 | Series B | 5-Sep-17 | 17.5 | 367.7 |

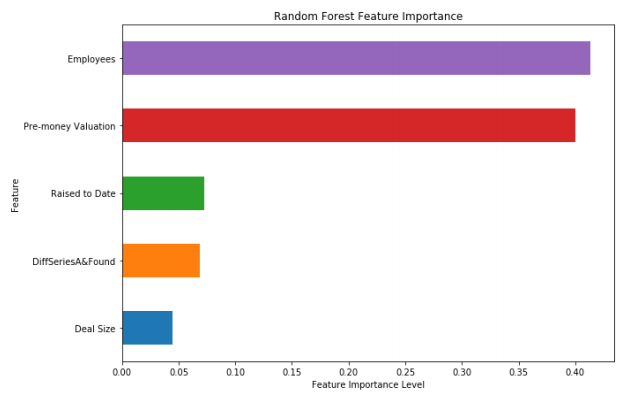

In looking at the random forest regression’s feature importance weighted scores, the following filters were given the highest weight for predicting an upcoming Series B Round.

- – Difference in numbers of employees from Series A to Series B

- – Difference in mark up in Pre Money-Valuation from A to B

The new addition of capital is directly linked to an incredible markup in the employee count. A startup would receive a ton of inbound interest after publishing that they have raised a new round. See the histogram below for a complete list of weighted scores.

Additional insights from the data:

The three main data points I found interesting are:

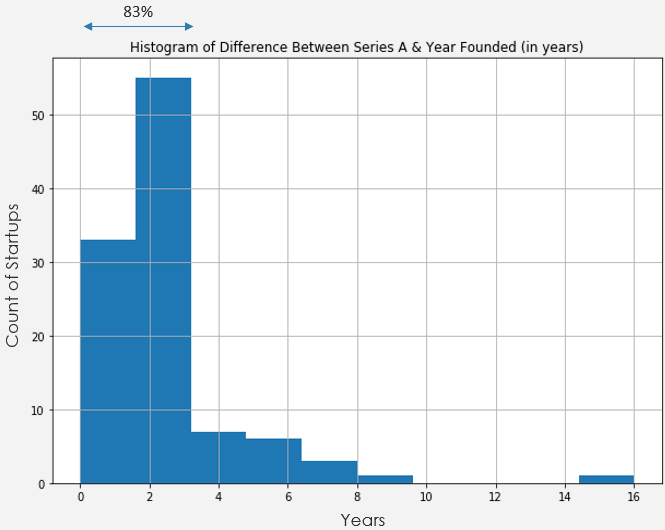

- – Within 3 Years of being founded, 83% of startups raise their Series A, and 66% of these startups go on to raise a Series B.

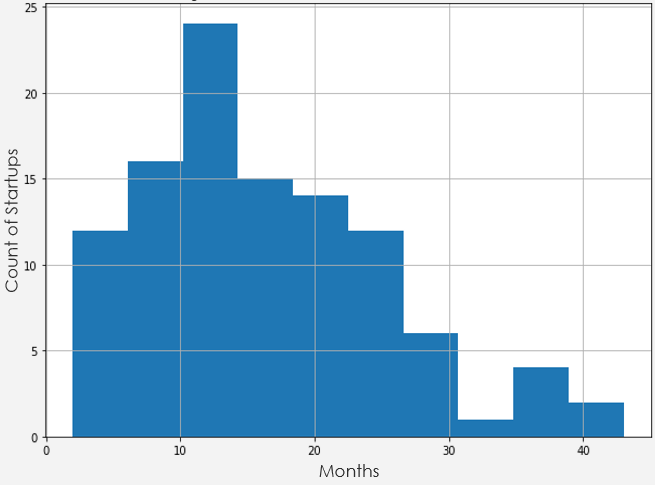

- – Series A startups take 10-18 months before raising their Series B financing round.

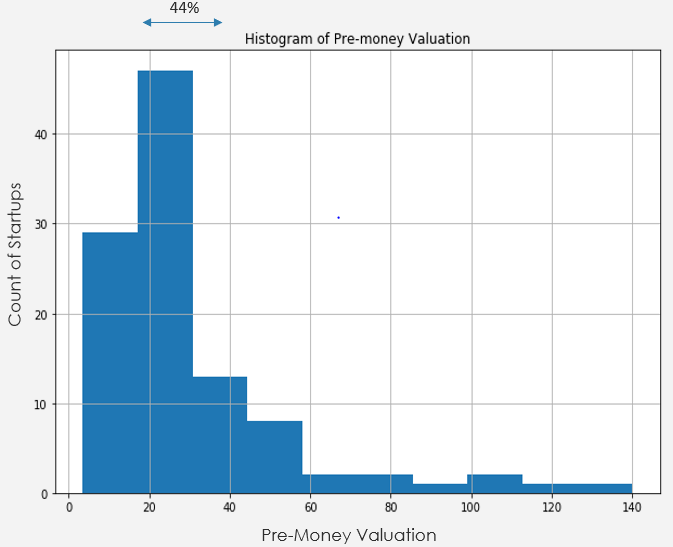

- – A little less than half of Series A startups (44% to be precise) have a pre-money valuation of $20M-$30m before raising their Series B Financing round.

So, who is likely to raise?

This is the real reason why you kept reading. After running the prediction model – below is the group of Series A companies that could end up raising their series B Round in the next four quarters starting in Q2 2021.

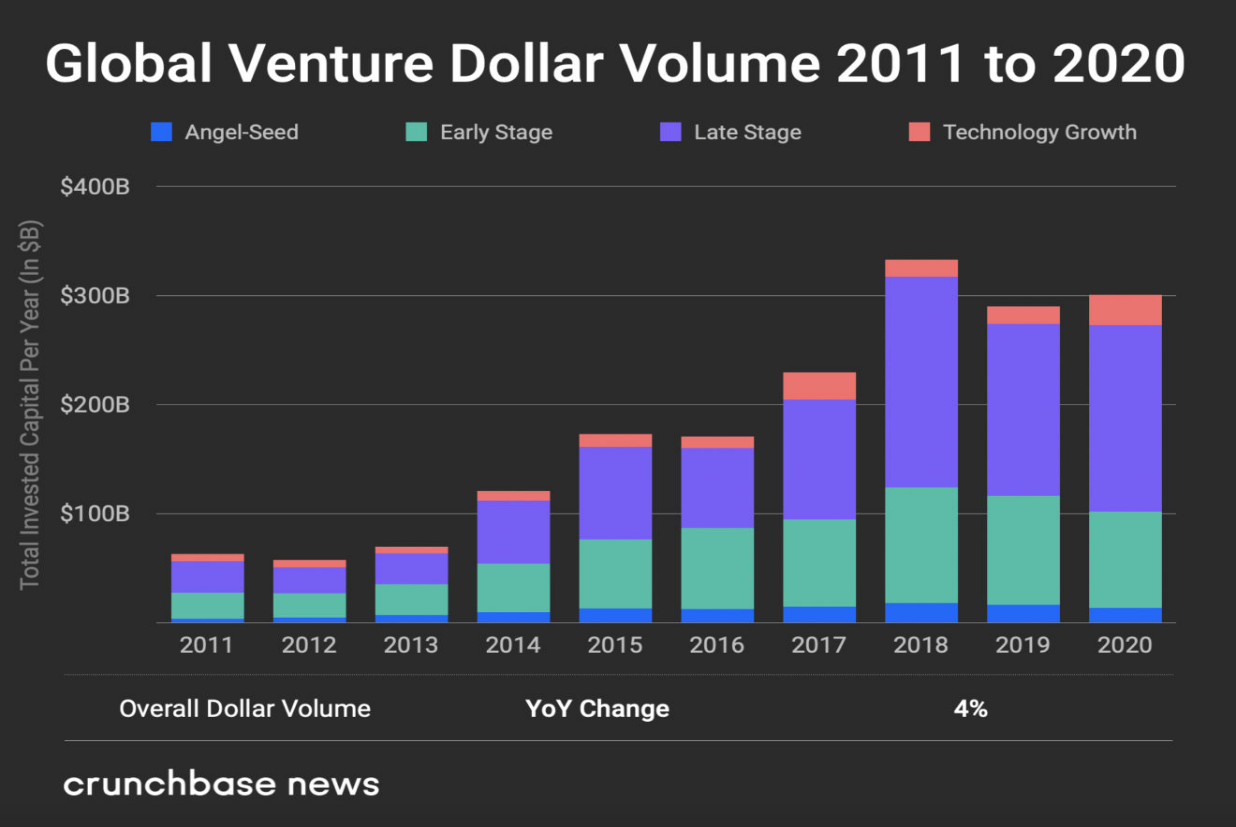

It would be fair to assume that the model does not take into consideration financing rounds that are pre-empted or companies coming out of stealth raising large Series A rounds. Startups closed out 2020 in a much stronger position than the one they started the year in, with global venture funding up 4 percent year over year to $300 billion. Moreover, deal volume has grown significantly through the decade. For Instance, 2011 featured 10,000 rounds from seed to late-stage mega-rounds, and now, the deal volume is close to 30,000 rounds (seed to late-stage) since 2017.

However, after looking at the results and the histograms above, the model could do well.

*As I was writing this blog post, a Techcrunch article came out announcing that Privacy rebranded to Lithic and raised a $43M Series B round. According to my prediction, I was off by a quarter.

Good luck investing!

- I hope you enjoyed reading. I would love to continue the conversation if you want to play around with the model or if you are one of the companies mentioned in the prediction analysis, and I got it wrong.

To learn more about me and what is going on at Arc Ventures follow us both on Twitter: @MMaulik11 and @Arc_Ventures. Shoutout to Rachel Payne and Eric Kohlmann for helping me structure the blog post.

________________________

About the Author: Maulik Mehta is an Associate at Arc Ventures. His role involves deal sourcing, conducting due diligence and creating value-add for Arc’s portfolio companies through customer and venture firm introductions. If you are a founder or a startup in deep tech, enterprise, automation, digital health, or fintech, please feel free to reach out at mmehta@arc-vc.com.

About Arc Ventures: Arc Ventures is a New York based venture capital firm invested in over 50 funds and startups across the US, Israel and Europe. The firm prefer to invest predominantly at the early stage (pre-seed to series B) and reserves a smaller share for late stage/ pre-IPO companies across Enterprise SaaS, FinTech + Prop-Tech, and FrontierTech.